Financial Success with Mastery of Budgeting: Your All-Inclusive Guide

Are you prepared to lead the path to financial success and take charge of your finances? You only need to become proficient in the art of budgeting. We’ll cover all you need to know about budgeting in this extensive guide, including its definition, significance, and useful methods, strategies, resources, and solutions. Together, we will empower you to reach your financial objectives.

Table of Contents

ToggleIntroduction

Greetings on your path to financial independence! Are you prepared to lead the path to financial success and take charge of your finances? You only need to become proficient in the art of budgeting. We’ll cover all you need to know about budgeting in this extensive guide, including its definition, significance, and useful methods, strategies, resources, and solutions. Together, we will empower you to reach your financial objectives.

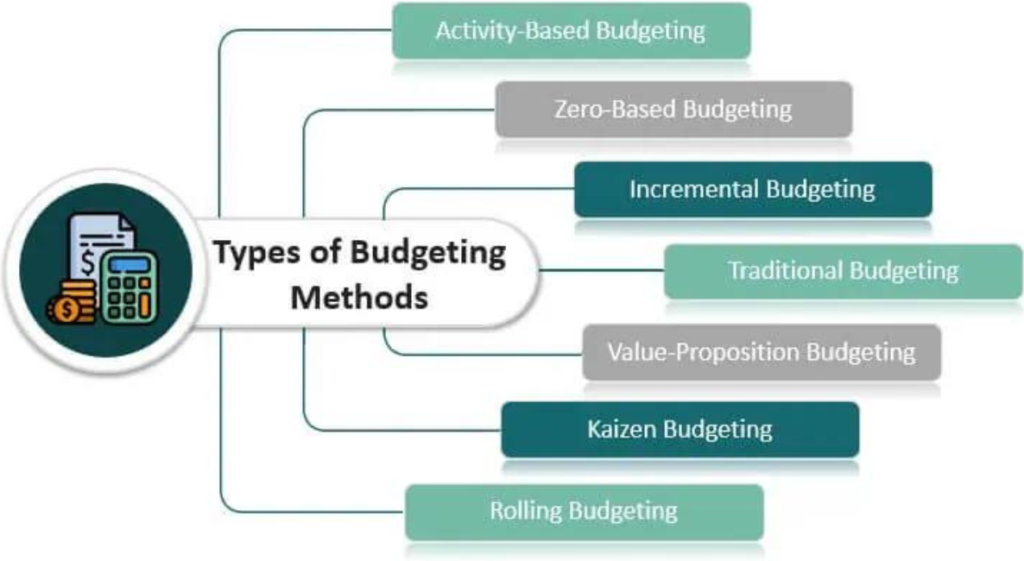

Types of Budgeting:

There is no one-size-fits-all strategy for budgeting. Different budgeting techniques exist, each designed to meet distinct financial objectives and needs. Let’s explore some of the most common types:

- Budgeting from Zero:Every spending in zero-based budgeting must be justified from the ground up, beginning at zero. This implies that every period’s budget is created from scratch, necessitating a careful review and rationale of each spending. It promotes effective resource allocation and spending prioritization according to objectives and current needs.

- Budgeting incrementally:Adding or removing a specific percentage or amount from the budget from the prior period is known as incremental budgeting. This method, which emphasizes small adjustments rather than starting from scratch when reevaluating the budget, is comparatively easy to understand and uncomplicated. Nevertheless, it can result in inefficient budgeting and miss out on possible ways to cut costs.

- Budgeting Based on Activities:With activity-based budgeting, financial resources are closely linked to particular projects or activities carried out by an organization. In order to allocate resources more accurately based on projected activity levels, a thorough analysis of the activities that drive costs and revenues is necessary. By matching budgets to strategic goals, this method promotes improved resource optimization and cost management.

- Adaptable Budgeting:Budgetary allotments are modified through flexible budgeting in response to variations in activity levels or other outside variables. In contrast to conventional static budgets, which stay the same regardless of actual performance, flexible budgets adjust to changes in the amount of demand, sales, or availability of resources. Organizations are better equipped to handle uncertainty and adapt to changes in their operational environment thanks to this flexibility.

- Monthly Budget Planner: There isn’t a one budgeting method that works for everyone. There are various budgeting strategies available, each tailored to certain financial goals and requirements. Let’s analyze a few of the more typical kinds:

- You Need a Budget (YNAB): In zero-based budgeting, all expenditures must start at zero and be fully justified. This suggests that the budget is made from start for each period, meaning that every expenditure must be carefully examined and justified. It encourages wise resource distribution and spending prioritization based on goals and demands at hand.

- Budget Maker: Incremental budgeting is the process of changing the budget from the previous quarter by a predetermined percentage or amount. This approach is quite simple to comprehend and stresses minor tweaks rather than beginning from scratch when reevaluating the budget. However, it may lead to ineffective budgeting and the loss of opportunities for cost-cutting measures.

- Biggest Financial Advisory Firms: With activity-based budgeting, financial resources are closely linked to particular projects or activities carried out by an organization. To enhance the accuracy of resource allocation based on anticipated activity levels, a comprehensive examination of the activities that influence expenses and income is necessary. This technique helps to improve cost management and resource optimization by aligning budgets with strategic goals.

- Financial Management: Flexible budgeting allows budgetary allotments to be adjusted in response to changes in activity levels or other external factors. Unlike traditional static budgets, which remain constant irrespective of real performance, flexible budgets adapt to variations in sales volume, demand, or resource availability. This flexibility helps organizations deal with uncertainty and adjust to changes in their operating environment.

Steps in Budgeting Process:

A number of procedures must be followed in order to guarantee careful planning and execution while creating an effective budget. Let us dissect the budgeting procedure into manageable steps:

- Setting Up Budgetary Objectives:Set attainable and unambiguous financial objectives first. Whether your goals are debt repayment, vacation savings, or retirement investments, setting clear goals for yourself can help you stay motivated and focused when creating your budget.

- Acquiring Financial Information:Gather all pertinent financial data, such as sources of income, costs, obligations, and savings. To acquire a thorough grasp of your financial status, this may entail going over bank statements, pay stubs, bills, and any other financial records.

- Making a Financial Plan:Create a thorough budget plan that lists all of your sources of income and outlays for a given time frame, usually a month or a year. List all of your sources of income first, and then set aside money for necessities like housing, utilities, groceries, and transportation. Don’t forget to set aside money for debt repayment, savings, and discretionary expenditures.

- Implementing the Budget:It’s time to implement your budget plan when you’ve created it. Maintain strict spending restrictions and meticulous expense tracking to make sure you’re remaining inside your financial limitations. Spreadsheets and budgeting applications are two examples of tools that may be used to track your progress and spot areas that could require improvements.

- Keeping an eye on and modifying the budget:Keep an eye on your expenditures and evaluate your progress toward your financial objectives by often reviewing your budget. Review your budget on a regular basis to find any areas where you might be underestimating or overpaying. To make sure that your budget stays reasonable and useful in assisting you in reaching your financial goals, be ready to make changes as necessary.

Techniques for Effective Budgeting:

- Measures for Cost Control:Pay careful attention to your spending and put cost-cutting initiatives in place. This can involve keeping tabs on your expenditures, figuring out where you can make savings, and coming up with methods to cut back on pointless spending. To reduce your overall spending, take into account techniques like meal planning, comparison shopping, and negotiating better prices on regular bills.

- Predicting financial outcomes:To better predict your financial demands, project your future income and expenses. To forecast your future income streams and expenses, use historical data and patterns. Be sure to account for things like seasonal swings, irregular expenses, and changes in income or expenses. Your ability to anticipate future events will enable you to prepare ahead and make wise financial decisions.

- Allocation of Resources:Make prudent use of your financial resources to make sure that your priorities and objectives are being met. Set spending priorities that align with your needs and ideals. Put more money toward savings and necessary costs and spend less on non-essentials. To get the most out of your resources and optimize the impact of your funds, use strategic allocation.

- Creating Reasonable Objectives:Establish attainable financial objectives that are consistent with your priorities and values. To make more ambitious objectives more reachable, break them down into more achievable benchmarks and monitor your advancement as you go. You can maintain your motivation and focus on reaching your financial goals by making clear goals and monitoring your progress on a regular basis.

- Frequent Evaluations of the Budget:Make sure your budget is still applicable and functional by reviewing and updating it on a regular basis. Don’t set it and forget it. Plan frequent check-ins to evaluate your expenditures, monitor your progress toward your objectives, and spot any areas that might require revisions. Take advantage of these reviews to adjust your budget and make any required adjustments to stay on course.

Tools and Software for Budgeting:

- Applications for Spreadsheets:Programs for creating spreadsheets, such as Google Sheets or Microsoft Excel, are useful resources for budgeting. They let you keep tabs on your earnings and outlays, make editable budget templates, and provide reports for financial data analysis. You may make calculations and view your budget in an easy-to-understand manner with the help of built-in formulas and functions.

- Apps for budgeting:Apps for budgeting include strong functionality and intuitive user interfaces to assist you in managing your money while on the road. Financial apps such as Mint, YNAB (You Need a Budget), and PocketGuard link to your credit cards and bank accounts to track spending, automatically classify transactions, and reveal information about your spending patterns. They also provide goal monitoring, budgeting tools, and tailored advice to assist you in meeting your financial objectives.

- Online Financial Management Platforms:Personal Capital and Quicken, two online financial management platforms, offer complete investment, retirement planning, and budgeting solutions. To give you a comprehensive picture of your financial status, these platforms include tools for budgeting, investment tracking, retirement calculators, and portfolio analysis. You may maximize your financial health by making informed decisions and gaining important insights into your finances with the help of customisable reports and user-friendly dashboards.

- Systems of Envelope Budgeting:Envelope budgeting methods, like the well-known app Goodbudget, simulate the conventional approach of creating a budget with paper envelopes for each category of spending. Using these approaches, you set aside a certain amount of money from your budget for each envelope and then monitor your expenditures. By using this technique, you can keep an eye on your expenditures and prevent overpaying in each area.

- Apps for Automated Investing and Savings:Apps for automated investment and savings, such as Acorns and Robinhood, can support your budgeting efforts by making it simple for you to save and invest money. These apps allow you to round up your regular purchases to the closest dollar and deposit any extra change into savings accounts or diversified portfolios. You may automate your investments and saves to increase your wealth over time while staying within your spending plan.

Challenges and Solutions in Budgeting:

Overcoming Challenges with Budgeting:

- Problem: Insufficient Financial Self-Control – Maintaining a budget can be challenging, particularly when confronted with the allure of excessive spending or impulsive purchases.

- Solution: Exercise Self-Control and Accountability – Establish plans to thwart impulsive purchases, such making a list of items to buy before you go shopping or setting a deadline for non-essential purchases. To stay on track with your financial goals, hold yourself accountable by periodically evaluating your budget and keeping track of your spending.

How to Handle Unexpected Bills:

- Challenge: Unexpected Expenses – Unexpected expenses can throw off even the most well-laid out budget; life is full of surprises.

- One potential solution is to create an emergency fund, which may be used to pay for unforeseen costs and financial emergencies. To have a safety net in case of need, try to save three to six months’ worth of living expenses in a different savings account. You may lessen the effect of unforeseen costs on your budget, keep other resources intact, and stay out of debt by keeping a safety net of funds.

Putting Effective Solutions Into Practice:

- Challenge: Difficulty Implementing Budgeting Solutions – Putting budgeting solutions into action can be difficult, particularly if you don’t know where to begin or don’t have the required help.

- Solution: Seek Professional direction and Assistance – Take into consideration getting advice and assistance from financial experts, such as credit counselors or financial consultants, who may offer specialized direction and support catered to your unique financial circumstances. They may assist you in creating a practical budget, pointing out areas that need work, and providing solutions to budgetary obstacles. In order to interact with people who are on the same budgeting road as you and exchange pointers, counsel, and encouragement, you might also think about joining online communities or support groups.

Benefits of Effective Budgeting:

There are several advantages to creating an effective budget that can help you with many areas of your financial life. The following are some major advantages of creating and adhering to an efficient budget:

- Stability of Finances:You can achieve more stability and control over your finances by making and following a budget. Setting up a budget enables you to better manage your money, set spending priorities, and prevent overspending. You’re therefore better prepared to manage monetary difficulties and unforeseen costs without jeopardizing your financial security.

- Debt reduction:You can strategically devote funds toward debt repayment with a well-planned budget. You may quicken the process of becoming debt-free by figuring out what your budget says about paying off debt. You may pay off debts faster, save money on interest, and become financially independent sooner if you have strict budgeting practices.

- Better Capability to Make Decisions:Creating a budget gives you important information about your financial status, empowering you to make wise financial decisions. You can determine areas where you might be overpaying or underspending by keeping track of your income and expenses. This will enable you to reorder your priorities. You can make better short- and long-term decisions by using a budget to help you define and implement realistic financial goals and strategies.

- Long-Term Budgeting:Setting up a budget is crucial for long-term financial planning and asset accumulation. Within your budget, you can set investing and savings goals to help you create a safe financial future. Whether you’re saving for retirement, buying a house, or paying for your kids’ schooling, budgeting enables you to allocate funds to your long-term goals and monitor your advancement over time.

- Diminished Stress Related to Money:Stress reduction related to money is one of the biggest advantages of good planning. You may reduce anxiety and stress about money by having a clear picture of your financial status and a plan in place for managing your finances. Peace of mind and improved general well-being can result from knowing that you’re in charge of your finances and making progress toward your objectives.

Conclusion:

Congratulations for starting down the path to financial success and budgeting mastery! Equipped with the knowledge and techniques presented in this guide, you can confidently and purposefully traverse your financial journey. Cheers to a prosperous and financially independent future!

Questions and Answers (FAQs):

How often should my budget be reviewed?

It is advised that you check your budget on a frequent basis—ideally once a month. This enables you to monitor your expenditures, evaluate how well you’re doing financially, and alter your budget as needed. On the other hand, you can decide to examine your budget more regularly, particularly if your financial circumstances or objectives significantly alter.

How should I proceed if I go over budget in a certain area?

Do not panic if you discover that you are going over budget in a specific area! Consider the reasons behind your overspending and any trends or routines that might be causing you to overspend for a moment. Redistributing money from other categories or finding methods to reduce spending in the overspent area will help you make the necessary adjustments to your budget. Take this as a chance to reflect on your past errors and proactively implement new measures to avoid overpaying in the future.

How can I include my family in creating our budget?

Including your family in the process of creating a budget might help them feel more accountable and collaborative. Start by talking about your family’s priorities and financial goals and getting feedback from each member. Assign distinct roles and duties, such as keeping tabs on spending or bringing forth ideas for ways to save costs. To discuss issues, recognize successes, and evaluate progress, think about scheduling frequent family budget meetings.

What are some typical errors to avoid while creating a budget?

Typical budgeting errors to steer clear of include:

- Establishing unreasonable standards or goals

- Failing to regularly track spending

- Not taking emergency or erratic expenditures into consideration

- Failing to modify your budget when your circumstances change financially

- Ignoring chances to invest or save money

- Feeling disheartened by comparing your budgeting experience to that of others