Crypto Trading: Types ,Strategies and Tips

Buying and selling cryptocurrencies on an exchange is known as cryptocurrency trading. Cryptocurrencies are digital or virtual tokens that regulate the generation of new units and safeguard transactions via the use of encryption. Since cryptocurrencies are decentralized, neither the government nor financial institutions can regulate them.

Crypto trading has been increasingly popular in recent years, as the value of cryptocurrencies has surged. However, because cryptocurrency values can change greatly, trading cryptocurrencies can also be dangerous.

We will provide a thorough introduction to cryptocurrency trading in this article. We will go over the fundamentals of cryptocurrency trading, such as the many kinds of deals, trading techniques, and top platforms for trading. We’ll also offer pointers for profitable cryptocurrency trading.

Table of Contents

ToggleWhat is Crypto Trading?

Buying and selling cryptocurrencies on an exchange is known as cryptocurrency trading. Online marketplaces known as cryptocurrency exchanges allow users to purchase, sell, and trade cryptocurrencies.

There are two primary forms of crypto transactions: spot trades and margin trades.

- Trades executed instantly at the going rate in the market are known as spot trades.

- Trades done using borrowed funds are referred to as margin trades. Because of this, traders are able to leverage their deals, which has the potential to both increase and decrease profits.

Types of Crypto Trading

Trading cryptocurrency comes in four primary forms:

- Spot trading: Buying and selling cryptocurrencies at the going rate on the market is known as spot trading.

- Trading on margin: Trading on margin is a kind of trading where traders can borrow money to make larger bets.

- Futures trading: This kind of trading enables participants to place bets on a cryptocurrency’s future price.

- Option trading : A kind of trading where traders have the option, but not the duty, to purchase or sell cryptocurrencies at a fixed price at a later time.

Crypto Trading Example

Purchasing Bitcoin (BTC) on a cryptocurrency exchange like Coinbase and then selling it later for a greater price is a basic example of cryptocurrency trading. We call this kind of trading “spot.”

Margin trading is another type of cryptocurrency trading. One kind of trading that enables traders to borrow money to enhance the size of their trades is called margin trading. Both gains and losses may be increased as a result.

Why is Crypto Trading Popular?

Crypto trading is popular for a number of reasons.

- Cryptocurrencies fluctuate in value. This implies that there may be large price fluctuations, which could present profitable trading opportunities for traders.

- It is decentralized to use cryptocurrencies. This indicates that neither the government nor financial institutions have any control over them.

- Cryptocurrencies exist everywhere. They can therefore be exchanged 365 days a year, around the clock.

What Benefits and Risks Come with Trading Cryptocurrencies?

Although trading cryptocurrencies is dangerous, it can also be incredibly profitable.

Risks:

- Volatility: Traders may suffer large losses as a result of the cryptocurrency’ volatility.

- Security: Crypto wallets can be stolen, and cryptocurrency exchanges can be breached.

- Regulation: Since cryptocurrency regulation is still in its infancy, it is possible that governments will enact laws that have the unintended effect of hurting the market.

Rewards:

- Potential earnings: Traders that engage in cryptocurrency have the opportunity to make big profits.

- Decentralization: Because cryptocurrencies are decentralized, traders are not governed by financial institutions or the government.

- Global market: Because cryptocurrencies may be traded around-the-clock, 365 days a year, traders have greater trading chances.

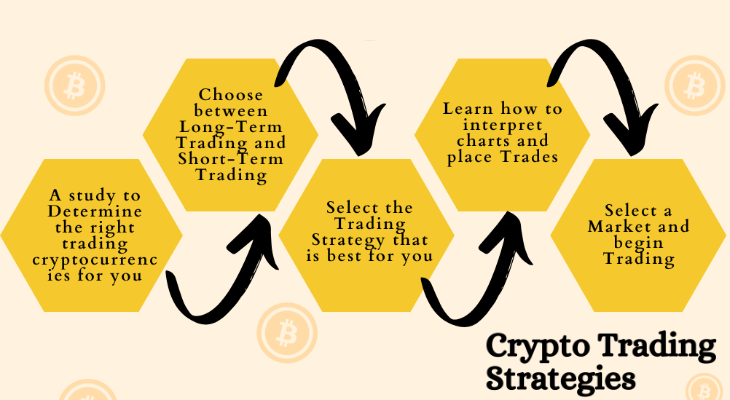

Strategies for Crypto Trading

Trading cryptocurrency can be done using a variety of techniques, such as position trading, swing trading, day trading, technical analysis, and fundamental analysis.

- Technical analysis: Technical analysis forecasts future price movements by utilizing past price data and chart patterns.

- Fundamental analysis: This kind of analysis examines the underlying elements, like as a cryptocurrency’s technology, team, and acceptance, that influence its value.

- Day trading: This kind of trading involves the purchase and sale of cryptocurrencies by traders inside the same day.

- Swing trading: is a kind of trading in which investors hold cryptocurrency for a few days or even weeks at a time.

- Position trading: In position trading, investors hold cryptocurrency for several months or even years.

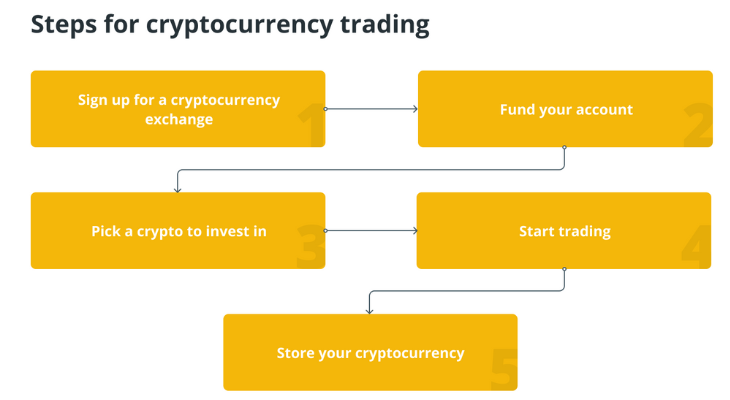

How to Get Started with Crypto Trading

- Pick a cryptocurrency exchange.

- Create an account and add cash or cryptocurrencies to it.

- After deciding which cryptocurrency to trade, submit your order.

Tips for Successful Crypto Trading

1.Do your research.

It’s crucial to conduct thorough study and comprehend the underlying technology, the project team, and the adoption rate of any cryptocurrency before you begin trading. The dangers of trading cryptocurrencies, like as volatility and security flaws, should also be known to you.

2.Start small

It’s crucial to start small when you initially start out. In the event that the market moves against you, this will allow you to minimize your losses. As you develop more confidence and experience, you can progressively increase the size of your investment.

3.Use a stop-loss order

A stop-loss order is a cryptocurrency sale order set at a specific price. If the market turns against you, you can use this to reduce your losses.

4.Take profits

It’s critical to consistently extract profits. By doing this, you’ll be able to protect your gains and avoid losing everything you made in the event that the market turns against you.

5.Diversify your portfolio

Don’t deposit all of your money in one particular area. To lower your risk, divide your investment among several cryptocurrencies.

6.Be patient

Trading cryptocurrencies requires patience. Don’t count on being wealthy soon. Remain patient and adhere to your trading strategy.

Here are some more pointers for profitable cryptocurrency trading:

For trading decisions, combine fundamental and technical analysis. To forecast future price movements, technical analysis looks at past price data and chart patterns. Examining the underlying elements that influence a cryptocurrency’s value, including as its technology, team, and acceptance, is known as fundamental analysis.

- Choose a reliable cryptocurrency exchange. There are lots of cryptocurrency exchanges available, so picking a reliable and secure one is crucial.

- For your cryptocurrency exchange account, make sure to set two-factor authentication (2FA) and use a strong password. This will lessen the likelihood of someone hacking into your account.

- Store your cryptocurrency in a safe wallet. Hot wallets and cold wallets are the two primary categories of cryptocurrency wallets. Unlike cold wallets, hot wallets have an internet connection. Although cold wallets can be more challenging to use, they are more secure.

- Recognize con artists. Scams abound in the cryptocurrency world. Any investment offer that looks too good to be true should be avoided.

Here are some of the common mistakes to avoid in crypto trading:

- Trading on emotion. One of the most common errors made by traders is this. It’s critical to maintain composure and reason when trading.

- Overtrading. Another typical error made by traders is overtrading. It’s critical to establish and adhere to a trading plan.

- Not using a stop-loss order. If the market moves against you, a stop-loss order might help you keep your losses to a minimum.

- Not taking profits. To lock in your winnings, it’s critical to take frequent profits.

- Putting all of your eggs in one basket. Diversifying your portfolio is crucial if you want to lower your risk.

Conclusion

Due to the sharp increase in cryptocurrency values in recent years, trading in cryptocurrencies has grown in popularity. However, because cryptocurrency values can change greatly, trading cryptocurrencies can also be dangerous.

We have included a thorough guide on cryptocurrency trading in this post. The fundamentals of cryptocurrency trading, such as the many kinds of deals, trading methods, and top platforms, have all been discussed. We’ve also included advice on how to trade cryptocurrencies profitably.

FAQs

What distinguishes margin trading from spot trading?

Buying and selling cryptocurrencies at the going rate on the market is known as spot trading. One kind of trading that enables traders to borrow money to enhance the size of their trades is called margin trading. Both gains and losses may be increased as a result.

What is the difference between futures trading and options trading?

A trading strategy that lets investors wager on a cryptocurrency’s future price is called futures trading. With options trading, investors have the option—but not the duty—to purchase or sell cryptocurrencies at a fixed price at a later time.

What are the risks of crypto trading?

Volatility and security flaws are the primary hazards associated with cryptocurrency trading. The prices of cryptocurrencies can swing dramatically, which makes them volatile. It’s also possible to hack cryptocurrency wallets and exchanges.

How can I mitigate the risks of crypto trading?

few steps can be taken to lessen the risks associated with trading cryptocurrency:

Before making any cryptocurrency investments, conduct research.

Use a reputable crypto exchange.

How can I learn more about crypto trading?

To learn more about cryptocurrency trading, there are a plethora of online and offline tools at your disposal. YouTube also has a ton of useful videos and tutorials.