Cryptocurrency :Advantages of cryptocurrency

The world is still fascinated with cryptocurrency, a revolutionary invention of the digital age that has drastically changed the financial landscape. These blockchain-powered digital currencies have revolutionized the financial industry by improving security, removing middlemen, and enabling cross-border transactions. Cryptocurrencies are a revolution in the way we store value, carry out transactions, and engage with the financial industry. They are not just another kind of money. In this examination of cryptocurrencies, we look at their history, mechanism, benefits, drawbacks, and potential future developments that could influence the financial industry going forward.

Table of Contents

ToggleHow Cryptocurrencies Work

The groundwork for cryptocurrency operations is laid by the groundbreaking blockchain technology, which permits safe, decentralized, and open digital transactions. This is how cryptocurrency functions:

- Blockchain Technology: Blockchain technology is the foundation of cryptocurrencies. A distributed ledger known as a blockchain keeps track of every cryptocurrency transaction made across a network of nodes, or computers. It’s frequently explained as a series of blocks, with a set of transactions contained in each block.

- Decentralization: Cryptocurrencies are not governed by a central body such as a bank or government, in contrast to traditional financial systems. Rather, the blockchain network functions on a peer-to-peer (P2P) model, in which every node, or participant, keeps a copy of the complete ledger.

- Cryptography: To safeguard transactions and manage the generation of new units, cryptocurrencies employ cryptographic techniques. Transactions are authenticated using both public and private keys. The private key is a secret code that permits transactions, whereas the public key functions as an address for receiving payments.

- Verification of Transactions: A cryptocurrency transaction is broadcast to the network by the individual who started it. By verifying that the sender’s private key and public key match and that they have enough money, nodes on the network validate the transaction. The transaction is added to a block after it has been verified.

- Mining (Proof of Work): To add new blocks to the blockchain, a method known as mining is used by many cryptocurrencies, including Bitcoin. Miners compete to find solutions to challenging mathematical riddles that call for a lot of processing power. In exchange for their efforts, the first miner to solve the riddle adds a new block to the blockchain and is rewarded with transaction fees and cryptocurrencies like Bitcoin.

- Consensus procedures: To guarantee that all nodes concur on the blockchain’s current state, cryptocurrencies employ consensus procedures. Delegated Proof of Stake (DPoS), Proof of Work (PoW), and Proof of Stake (PoS) are popular approaches. For example, PoS enables users to “stake” their coins as collateral for transaction validation, but PoW requires miners to prove computational labor in order to generate new blocks.

- Immutability and Transparency: Transactions are permanent once they are added to the blockchain and cannot be removed. Everyone has access to the blockchain record, making transaction history visible to all. This openness promotes user trust and aids in the prevention of fraud.

- Wallets: Digital wallets allow users to transact using cryptocurrencies. A user’s private keys are kept in a wallet, which enables them to transfer and receive cryptocurrency. Wallets can be hardware-based or software-based (website or mobile apps).

- Peer-to-Peer Transactions: Without the use of middlemen like banks, cryptocurrencies enable direct peer-to-peer transactions. Users are given complete control over their money and the opportunity to transact internationally thanks to this functionality.

How to buy cryptocurrency

- Choose a Reputable Exchange: To begin with, pick a trustworthy cryptocurrency exchange or platform to purchase and sell on. Bitstamp, Kraken, Binance, and Coinbase are a few of the well-known exchanges. Make sure the exchange you select accepts the cryptocurrency you wish to purchase and is operational in your area.

- Create an Account:Register on the preferred exchange by filling out the necessary verification forms, which frequently call for submitting identity documents like a passport or driver’s license, along with your personal information.

- Secure Your Account:For extra security, turn on two-factor authentication (2FA) on your exchange account. Usually, this entails getting SMS codes or connecting your account to a mobile app like Google Authenticator.

- Select a Wallet:For extra security, it’s advised to utilize a separate bitcoin wallet even though many exchanges offer online wallets. There are several types of wallets: hardware wallets, which are actual devices, and software wallets, which are desktop or mobile programs. Trezor, Ledger, and software wallets like Electrum and Exodus are popular wallet choices.

- Set Up Funds:Put money into the exchange account you have. Depending on what the exchange offers, you can usually deposit money using a bank transfer, credit/debit cards, or other payment options.

- Place an Order:Make an order on the exchange to purchase the cryptocurrency you want. Both the quantity and the price that you are willing to buy can be specified. Various order types exist, including limit orders (purchase at a predetermined price) and market orders (purchase at the going rate).

- Execute the Purchase:The bitcoin will be credited to your exchange account if a seller matches your request. To verify the purchase, check your balance or wallet.

- Put Money in Your Wallet:Move the cryptocurrency you bought from the exchange to your personal wallet for further security. This step lowers the possibility of loss from exchange-related complications and guarantees that you maintain complete control over your assets.

- Remain Updated:Remain up to date on local rules, security best practices, and the state of the cryptocurrency industry. Keeping abreast with cryptocurrency values is crucial because they can fluctuate greatly.

- Be Cautious:Watch out for phishing attempts and scams. Keep your wallet information and private keys confidential. Offers that seem too good to be true should be avoided, and you should always confirm the validity of any exchange or service you use.

What can you buy with cryptocurrency?

- Choose a Reputable Exchange:To begin with, pick a trustworthy cryptocurrency exchange or platform to purchase and sell on. Bitstamp, Kraken, Binance, and Coinbase are a few of the well-known exchanges. Make sure the exchange you select accepts the cryptocurrency you wish to purchase and is operational in your area.

- Create an Account:Register on the preferred exchange by filling out the necessary verification forms, which frequently call for submitting identity documents like a passport or driver’s license, along with your personal information.

- Safeguard Your Profile:For extra security, turn on two-factor authentication (2FA) on your exchange account. Usually, this entails getting SMS codes or connecting your account to a mobile app like Google Authenticator.

- Select a Wallet:For extra security, it’s advised to utilize a separate bitcoin wallet even though many exchanges offer online wallets. There are several types of wallets: hardware wallets, which are actual devices, and software wallets, which are desktop or mobile programs. Trezor, Ledger, and software wallets like Electrum and Exodus are popular wallet choices.

- Set Up Funds:Put money into the exchange account you have. Depending on what the exchange offers, you can usually deposit money using a bank transfer, credit/debit cards, or other payment options.

- Make a Purchase:Make an order on the exchange to purchase the cryptocurrency you want. Both the quantity and the price that you are willing to buy can be specified. Various order types exist, including limit orders (purchase at a predetermined price) and market orders (purchase at the going rate).

- Carry Out the Buy:The bitcoin will be credited to your exchange account if a seller matches your request. To verify the purchase, check your balance or wallet.

- Put Money in Your Wallet:Move the cryptocurrency you bought from the exchange to your personal wallet for further security. This step lowers the possibility of loss from exchange-related complications and guarantees that you maintain complete control over your assets.

- Remain Updated:Remain up to date on local rules, security best practices, and the state of the cryptocurrency industry. Keeping abreast with cryptocurrency values is crucial because they can fluctuate greatly.

- Be Cautious:Watch out for phishing attempts and scams. Keep your wallet information and private keys confidential. Offers that seem too good to be true should be avoided, and you should always confirm the validity of any exchange or service you use.

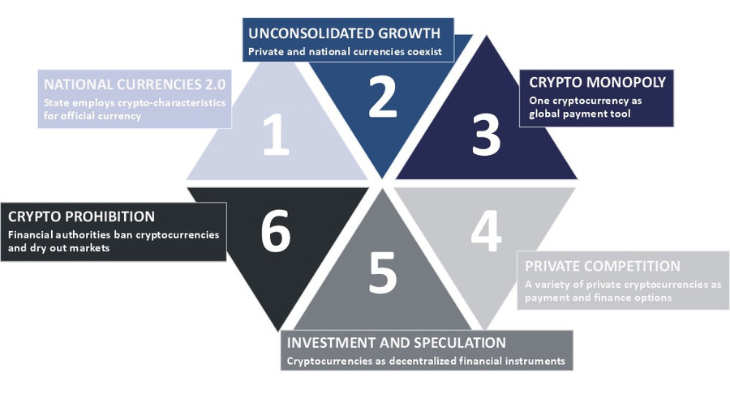

Why is cryptocurrency the future of finance?

For a number of reasons, cryptocurrency is frequently seen as the financial technology of the future. It provides a degree of financial inclusion that conventional banking systems are unable to equal, first and foremost. Anyone with an internet connection can access cryptocurrencies, allowing billions of underbanked or unbanked people to engage in the global economy.

Furthermore, cryptocurrencies enable quick and inexpensive cross-border transactions, transforming global trade and remittances. Because they are not constrained by bureaucratic procedures or regular banking hours, financial transactions are more accessible and efficient globally.

The basis of cryptocurrencies, blockchain technology, guarantees immutability, security, and transparency in financial transactions. By doing this, fraud is decreased, middlemen are no longer necessary, and system confidence is increased. Moreover, the notion of smart contracts holds promise for streamlining and automating financial agreements and services as they automatically carry out predetermined activities upon satisfying particular conditions.

The decentralized structure of cryptocurrencies provides defense against governmental meddling and inflation as well. Cryptocurrencies can act as a hedge against economic instability and a store of value as governments issue more money and economies face uncertainty.

All things considered, bitcoin seems to be becoming more and more entwined with the future of finance as it solves many of the shortcomings of established financial systems and creates new avenues for financial innovation and inclusivity.

Why invest in cryptocurrency?

For several reasons, investing in cryptocurrencies might be a desirable choice.

- Possibility of Large Returns: Cryptocurrencies have demonstrated a considerable potential for large investment returns. Over time, the value of bitcoin and other digital assets has increased significantly, providing early investors with huge returns.

- Diversity: By adding cryptocurrencies to your financial portfolio, you can lower total risk through diversity. Since cryptocurrencies and conventional asset classes like equities and bonds sometimes have minimal correlations, cryptocurrencies can serve as a hedge against market volatility.

- Accessibility: Anyone with an internet connection may access cryptocurrencies, which makes them a good investment choice for people all over the world. People can engage in the digital economy without using traditional banking or financial middlemen thanks to this accessibility.

- Worldwide Market: Unlike traditional financial markets with regular trading hours, cryptocurrencies operate on a worldwide scale and offer chances for trading and investment around the clock.

- Innovation: The blockchain technology that powers cryptocurrencies has the power to completely transform a number of sectors, not only the financial sector. Purchasing bitcoins entails contributing to and encouraging the advancement of cutting-edge technologies.

- Store of Value: Like digital gold, some people see cryptocurrencies like Bitcoin as a store of value. They might serve as a buffer against fluctuations in the economy and inflation.

- Financial Inclusion: By offering financial services to those who are underbanked or unbanked, cryptocurrencies can foster both financial inclusion and economic empowerment.

- Speculative possibilities: Due to the cryptocurrency market’s notorious volatility, traders may find possibilities for speculation. Temporal price swings present an opportunity for rapid financial gains.

- Volatility: The prices of cryptocurrencies are prone to sharp and sudden swings, making them extremely unstable. It’s critical to be ready for any setbacks.

- Absence of Regulation: Regional variations characterize the constantly changing regulatory environment surrounding cryptocurrencies. For investors, this absence of consistent regulation may be unsettling.

- Security Risks: To safeguard your digital assets from loss and hacking, holding and managing cryptocurrencies necessitates a solid awareness of security protocols.

- Study & Due Diligence: Before making any bitcoin investments, it is imperative to perform in-depth study. Recognize the team, technology, project, and issues it seeks to resolve.

- Long-Term vs. Short-Term: Take your time to invest and your tolerance for risk into account. Those with a long-term outlook might be better suited for cryptocurrency investments.

What is a stablecoin?

Stablecoins are a subset of cryptocurrencies that are intended to keep their value constant. They are usually linked to one or more fiat currencies (such as the US dollar), commodities, or other cryptocurrencies. Stablecoins are a more dependable medium of exchange and store of value since they try to reduce price swings, in contrast to more erratic cryptocurrencies like Bitcoin or Ethereum. Stablecoins typically come in three varieties:

- Fiat-Collateralized Stablecoins: These stablecoins are supported by a reserve of fiat money kept in a bank account, such as US dollars. Usually, each stablecoin that is minted has a 1:1 peg, meaning that it is fully backed by an equivalent quantity of fiat money. Well-known instances are TrueUSD (TUSD), USD Coin (USDC), and Tether (USDT).

- Crypto-Collateralized Stablecoins: These stablecoins, which are often held on a decentralized platform or smart contract, are backed by a reserve of other cryptocurrencies. These stablecoins frequently over-collateralize their reserves in order to preserve price stability. Ethereum, for example, is used as collateral in MakerDAO’s DAI.

- Algorithmic Stablecoins: These digital currencies are not dependent on tangible reserves. Rather, they manage the stablecoin’s supply with algorithms and smart contracts. More stablecoins are produced when the price surpasses the target, and some are burned when the price declines in order to preserve stability. For Example.Terra (LUNA) and Ampleforth (AMPL).

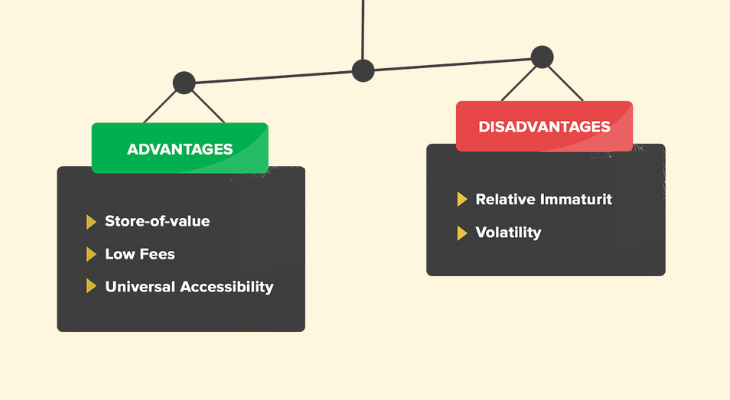

Advantages and disadvantages of cryptocurrency:

Advantages:

- Security: The use of cryptography to safeguard cryptocurrency transactions makes them extremely safe and impervious to fraud or hacking.

- Decentralization: Because cryptocurrencies run on decentralized blockchain networks, they do not require middlemen like banks or governmental oversight.

- Accessibility: Anyone with an internet connection can use cryptocurrencies, giving the underbanked and unbanked access to financial services.

- Quick and Cheap Transactions: Compared to regular banking or international transfers, cryptocurrency transactions are frequently quicker and less expensive.

- Ownership and Control: Users have complete ownership and control over the bitcoin assets they possess, which lowers the possibility of asset confiscation or account suspension.

- Financial Inclusion: Individuals in areas with restricted access to traditional banking might benefit from financial services offered by cryptocurrencies.

- Transparency: By recording every transaction, the blockchain ledger ensures transparency and lowers the possibility of fraud.

- Innovation: The creation of smart contracts and decentralized applications (DApps) is made possible by cryptocurrencies, which promotes innovation across a range of sectors.

- Protect Yourself From Inflation: Some people view cryptocurrencies like Bitcoin as a protection against both inflation and unstable economic conditions.

Disadvantages:

- Price Volatility: Due to their reputation for price volatility, cryptocurrencies pose a danger to investors and as a means of exchange.

- Absence of Regulation: Users in the cryptocurrency ecosystem may be vulnerable to fraud, scams, and market manipulation due to the absence of explicit regulations.

- Irreversible Transactions: Since cryptocurrency transactions are irreversible, money can lose and errors are difficult to fix.

- Technical Complexity: Newcomers may find it frightening to possess the technical expertise needed to comprehend and utilize cryptocurrency.

- Absence of Consumer Protection: Due to the absence of consumer protection regulations, users have few options for getting back cryptocurrency that has been misplaced or stolen.

- Market Speculation: Speculation is a major factor in cryptocurrency markets, frequently causing price bubbles and manipulating the market.

- Energy Use: Proof-of-work cryptocurrencies, such as Bitcoin, use a lot of energy, which raises questions about how they may affect the environment.

- Limited Acceptance: The vast range of opinions regarding cryptocurrency limits its application to regular transactions.

- Anonymity Issues: Because cryptocurrencies are pseudonymous, they have been linked to illicit activity even though they do provide some degree of anonymity.

- Loss of Private Keys: If you are unable to access your private keys, you may lose access to your cryptocurrency permanently.

Conclusion

To sum up, cryptocurrency is a major advancement in the fields of technology and finance. From the inception of Bitcoin to the wide range of digital assets that are accessible now, the industry has experienced innovation, difficulties, and a quickly growing ecosystem. A new era of financial equality and creativity has been made possible by the decentralized nature, security features, and accessibility of cryptocurrencies, which have upended established financial structures.

FAQs:

What is the difference between Bitcoin and Ethereum?

Bitcoin’s main uses are as a digital currency and store of value. Ethereum is a platform on which smart contracts and decentralized applications (DApps) can be developed.

What is a private key?

A cryptographic key known as a private key gives you access to and management over your bitcoin assets. Keep it safe because if you lose it, you will also lose access to your assets.

Can I mine cryptocurrency?

Verifying and appending transactions to a blockchain is known as mining. Even though mining Bitcoin demands a lot of processing power, several cryptocurrencies can still be produced effectively with technology that is more common.

How can I protect myself from cryptocurrency scams?

Be wary of unsolicited offers and confirm the veracity of communications and websites. Don’t give anyone access to your private keys or confidential information. To be on the lookout, familiarize yourself with typical bitcoin frauds.

2 Comments